What’s in Fintech and where is the money going?

Fintech investments in the last four years are most focused on payments, lending and digital banking. On closer look, VCs seem to be underinvesting into insurtech, and overinvesting into lending.

When I tell people I’m working in Fintech, they usually look at me, nod and expect an elaboration. Fintech is a massive space with various subsectors. The common thread is that it involves money and technology.

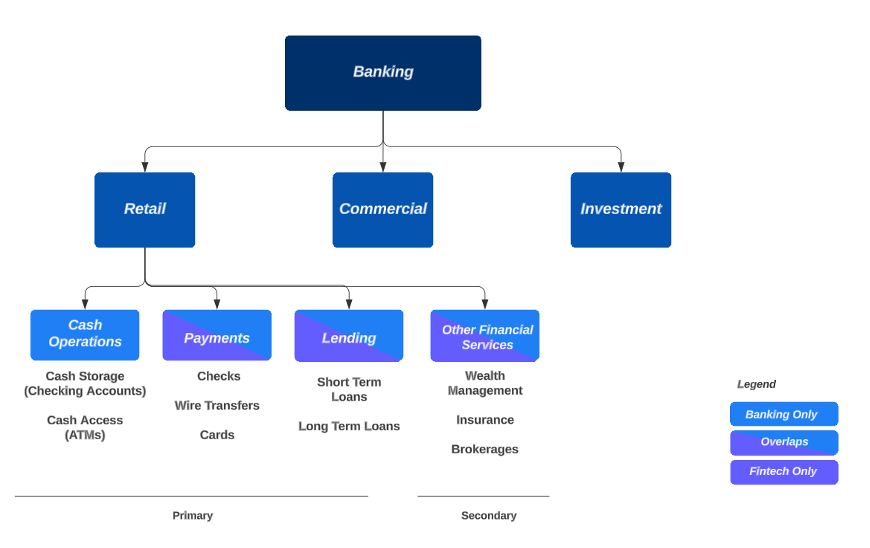

Here, it helps to visualize a bank. Most consumers think of money withdrawals when we think of a bank. But when you look closer, there are different categories of banking services – retail (caters to consumers), commercial (for merchants), investment banks (for M&As etc). Within each category, there are also subcategories. For example, consumer banks cover services across deposits, payments, lending etc.

What is Fintech?

Fintech services have overlaps with traditional banking, and add ons, as a result of digitisation. I have narrowed down the key classifications in fintech after browsing through both CB Insights and Pitchbook’s resources.

As I see it, the primary functions of fintech are largely industry agnostic, while the secondary layers focus on industry specific applications.

While there are overlaps and similarities with traditional banks, fintech differs with first a more modern tech stack, a decomposable approach that allows creation of nontraditional workflows, and new innovations as a result of data, identity and technology.

So, where is the money going?

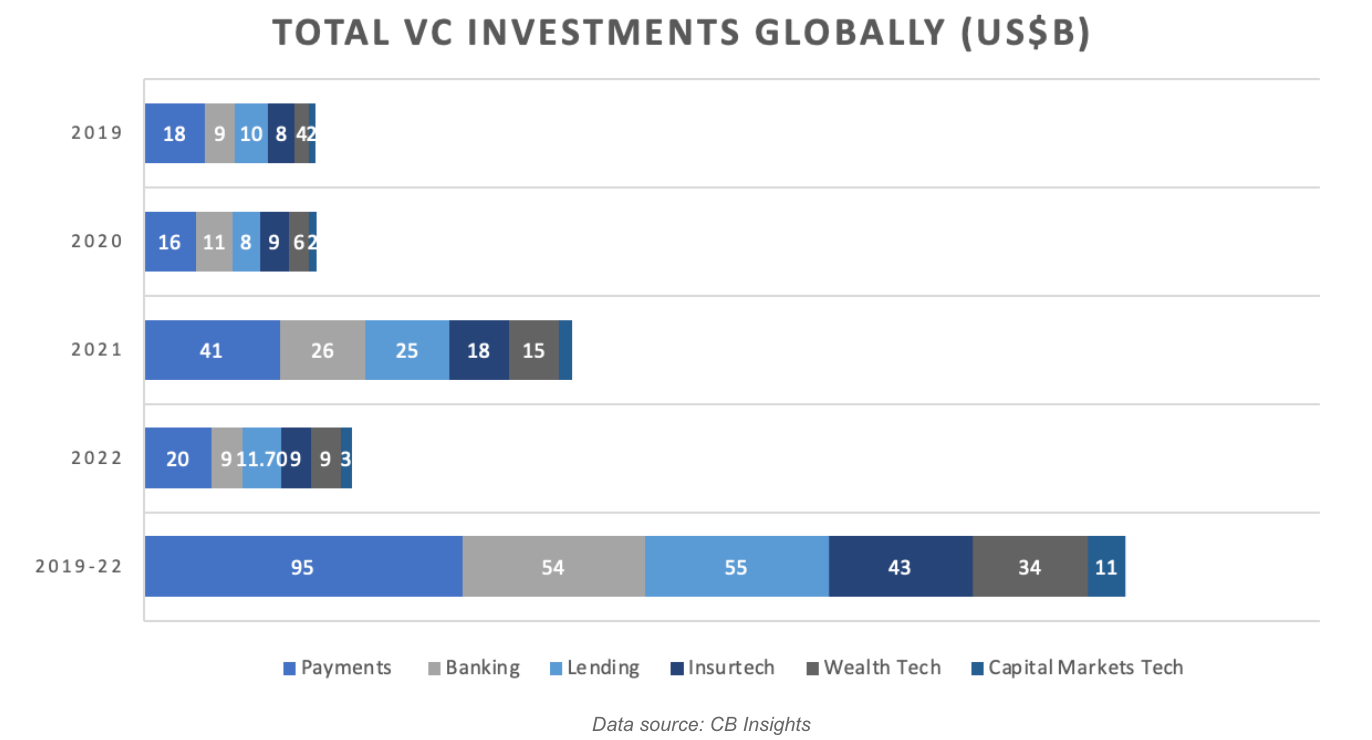

Looking at data over the past four years, both CB Insights and Pitchbook are in unison that funding activity is highest for the following sectors: Payments, Lending, Banking.

Payments funding leads significantly, while banking and lending tie in shoulder to shoulder. In fact, payments accounts for a third of total funding in the last 4 years.

Wealthtech and Capital Markets tech are growing fast when we compare YoY growth, but collective funding over the four years is still significantly below that of the top 3 categories of payments, banking and lending.

I believe three reasons explain why investments into these top 3 categories areas are strong: market size, growth rate and industry structure.

Market Size

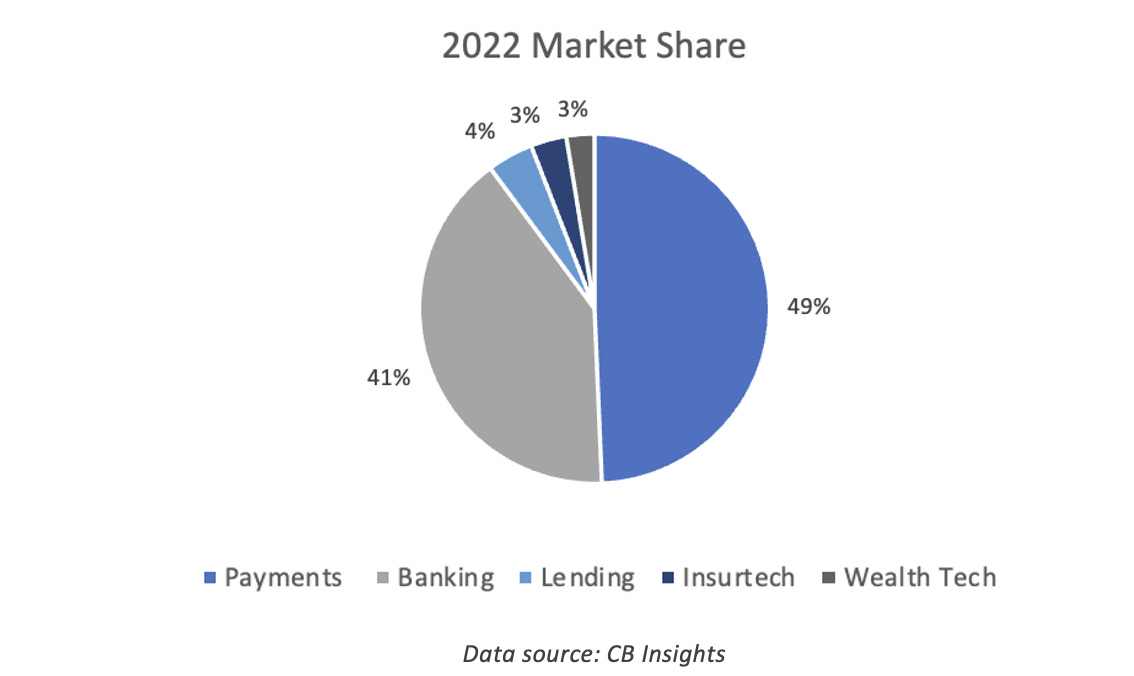

I posit these activities form a larger share of the economy, and hence have a larger addressable market. Payment transactions reflect the flow and exchange of money which is the heart of any economy. Lending is an accelerant for business activity. Banking, while mature, will be increasingly digital going forward and benefit from increasing demand from developing countries. All these business lines are also beneficiaries of the pandemic, which has accelerated the push towards digital adoption.

Looking at the data, we do see payments, banking and lending leading the existing market size. I am slightly surprised by the small size of the digital lending market! I imagine that either lending is a small share of the economy, or that commercial loans are slow to digitize.

Growth Rate

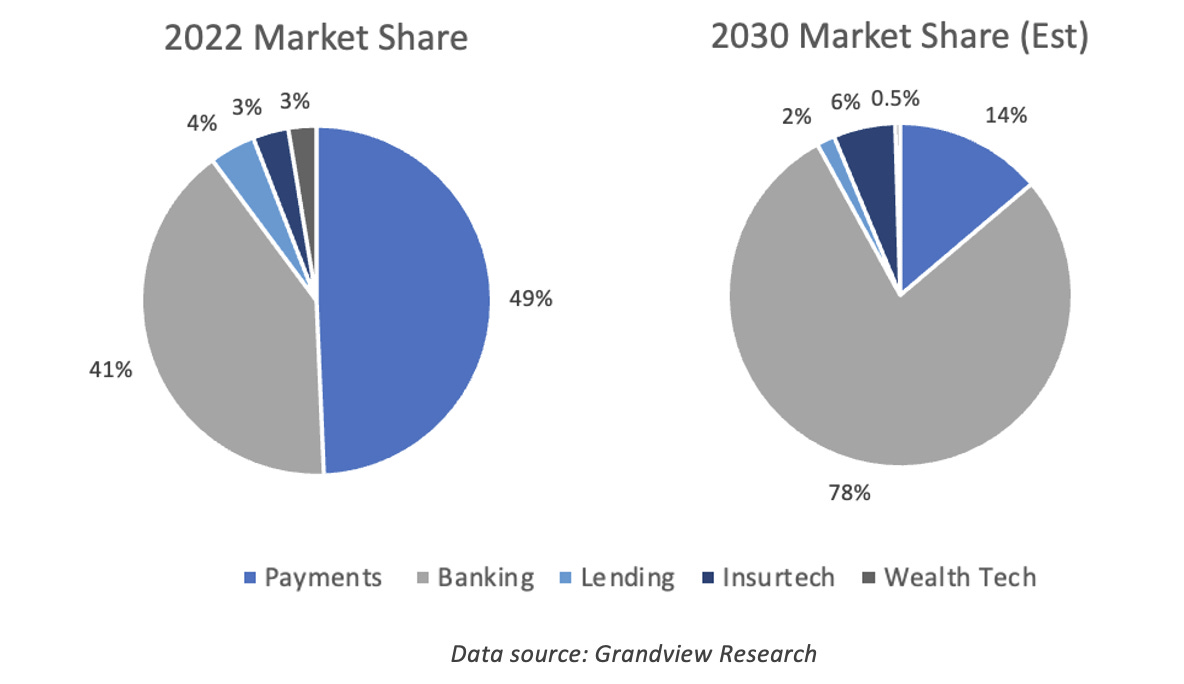

Industry growth rate is another factor to determine investment returns. Here, we see that banking and insurtech are the frontrunning industries, raking in an estimated projected CAGR of more than 50% (other sectors have a CAGR of 15-30%).

While the high projected CAGR could explain the funding for digital banking, I am surprised that the strong growth potential of insurtech is not attracting more investments.

Industry Structure

Finally, I believe that industry structure is a key determinant in market entry. This includes the current competitive landscape, capital and implementation barriers, customer switching costs and regulation.

For a start, the payments business has lower capital and implementation barriers. Setting up a payments business does not require significant capital investment (relative to a loans business), or deep technical expertise (relative to AI).

I’m guessing a possible reason for insurtech’s smaller investment despite a large market potential is that it is a more highly concentrated industry with long-term customer relationships. For example, life insurance plans once committed are difficult to switch without incurring charges.

In summary:

Fintech differs from traditional banking by its flexibility to enable non-traditional product journeys and workflows

Fintech money has been poured into payments, lending and digital banking, but wealthtech and capital markets tech are emerging as fast growth areas.

On closer look, VCs seem to be underinvesting into insurtech, and overinvesting into lending.

Overall, the result of these investments could mean that we can expect more developments in these sectors going forward. In my next few posts, I’ll provide insight into the types of startups in each of these categories that are getting the lion’s share of funding.

Hi, great read. We'd be happy to recommend.

Thanks Dawn. What’s responsible for the big shrinkage in market share of Payments from 2022 to the 2030 projections and conversely, the explosion of Banking? Does this reflect consolidation of other services into banking? Is this the future expectation?